Rising real estate values are once again driving significantly higher City of Boston property taxes for fiscal 2019. Area homeowners are seeing a consistent mid-to-high single digit assessment increase from the city’s mailing of its recent property tax bills due on February 1st.

The median home value in the North End is $717,800, according to Zillow, translating to an annual property tax bill of $7,565. Downtown Boston values are higher with a median value of $1,069,600. That means paying a property tax levy of $11,273, under the new residential rate.

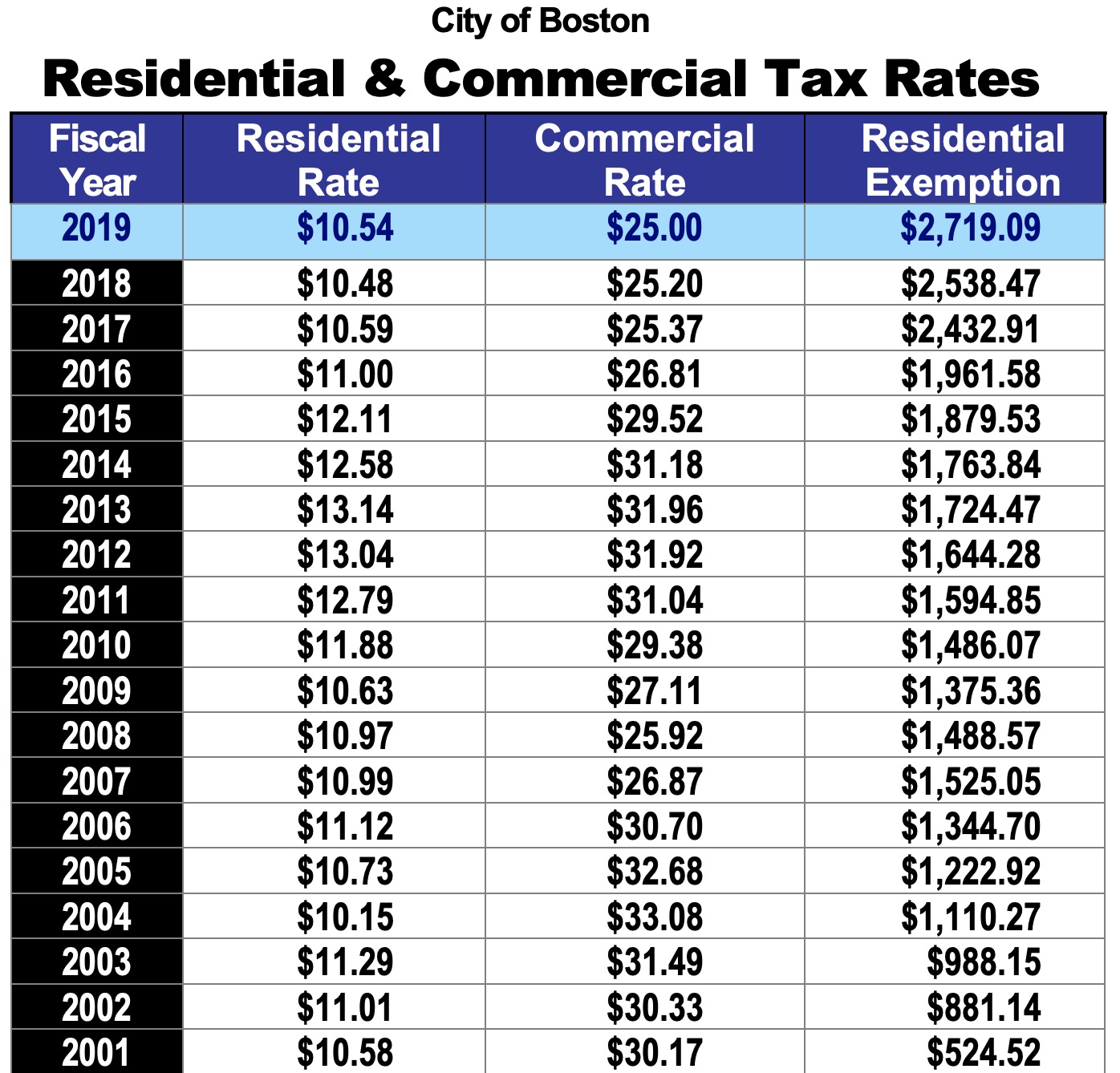

The city’s residential tax rate increased marginally this year, from $10.48 to $10.54 per thousand dollars value. However, citywide property assessments increased high-single digits on a percentage basis, following a similar increase last year. The commercial rate actually decreased slightly. Because residential values are rising faster, homeowners will bear more of this year’s tax increase.

In a spot of relief, the owner-occupied residential exemption increased this year to $2,719 from $2,538. Owners can also file for the residential exemption credit if they own and occupy a property as of the previous January 1st.

Roughly 70% of the City’s budget is funded by real estate taxes. With its higher values, the downtown Boston neighborhoods pay the majority of property taxes in the city.

There are two factors that directly change an owner’s property tax: (1) a change in the assessed value and (2) a change in the tax rate. Boston’s property tax system reflects a “see-saw” between commercial and residential taxes. When commercial property tax values are down (or rise slower) due to the economy, a higher burden shifts to residential properties.

The higher City tax levy is generally split with about half of the increase coming from the 2.5% increase allowed under Proposition 2 1/2 and the rest coming from new development added to the tax base.

Property owners can file for a tax abatement if they believe their assessment is incorrect. The deadline to file for a tax abatement is February 1st.

Yeah …. whatever. Assessment is a farce. Only allows you the opportunity to get screwed less …. maybe.

I agree assessment is a farce and Marty Walsh instead of giving himself a raise should apply that to the taxes enough is enough. If Commercial property doesn’t sell why do my taxes have to increase? Property taxes keep increasing yet the streets are a mess, the rats are running rampant, there’s holes all over the city and now huge rats at the New Market really what are we paying for?

Yeah, but the T is fantastic! 🙂

My understanding was that the taxes could only go up 2.5% per year under prop 2 1/2. But earlier in the article it cites that many homeowners are seeing a mid to high single digit increase. What am I missing?