A new bill by State Representatives Aaron Michlewitz and RoseLee Vincent would introduce the strictest regulations in the country for short-term rentals by companies such as AirBnb, Homeaway and Flipkey. Both Democrats, Michlewitz represents the North End, South End and parts of downtown Boston while Vincent hails from Revere.

The legislation, if passed, would legalize the gray-area of short-term residential rentals, while imposing safety and registration requirements along with a 5% tax similar to those of hotels.

“Short-term rentals are a growing concern in communities across the Commonwealth,” said Representative Michlewitz. “While short-term rental platforms are a testament to the innovative economy that has thrived in Massachusetts, we want to ensure that they are safe and secure places that work within the rules and regulations that the hospitality industry already operate under.”

The bill empowers cities and towns to inspect short-term rental units for safety code violations. Under the Department of Housing and Community Development, the State would track short-term rental units using a registration program. Notably, the proposed legislation mandates a 5% excise tax, similar to a hotel tax. Tax revenues would go toward funding tourism.

“Many of our urban communities have seen a surge in short-term rental units, which is alarming because there are no laws regulating such housing,” said Representative RoseLee Vincent (D-Revere). “What this legislation seeks to do is to make short-term rental units safe and allow for the owners of the properties to be held accountable for any impact the rentals may have on the community. For the health and safety of our residents, it is important that we regulate such housing.

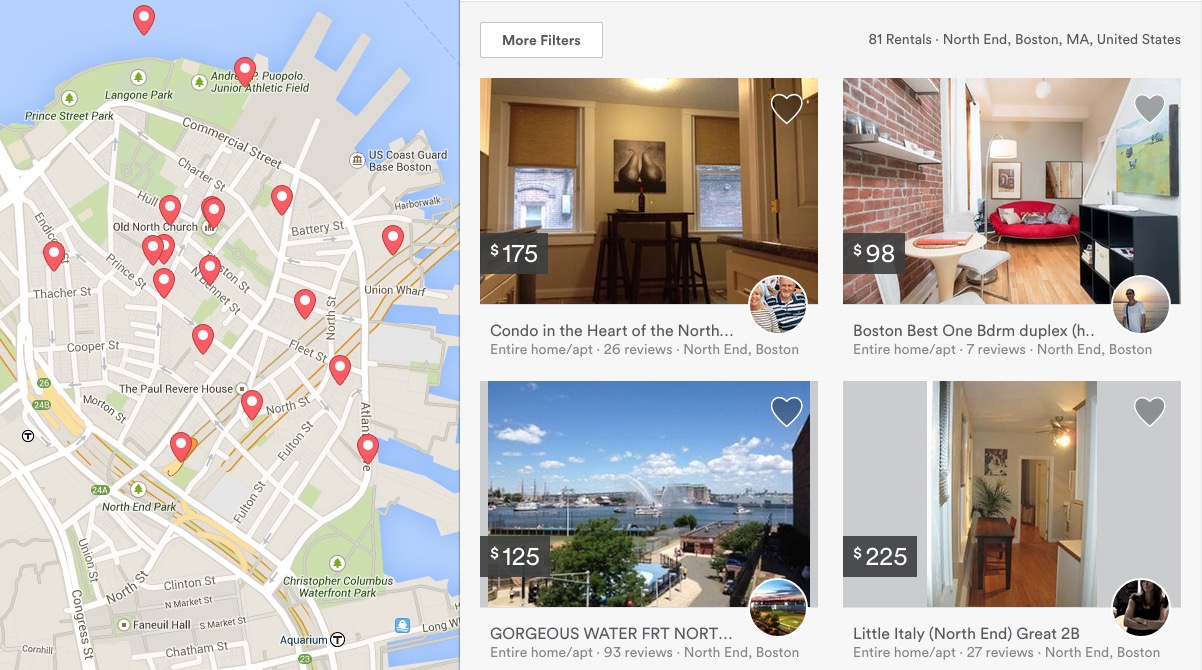

The effort at the State level to regulate short-term rentals is running parallel to that in the City of Boston. Councilor Sal LaMattina (North End, Charlestown, East Boston) has filed for a hearing to develop regulations in Boston. The city is also hosting a community meeting on January 26th on the issue. In addition to safety and tax issues, residents have expressed concerns that AirBnb-type services are absorbing much of the available housing stock. Listings for regular apartments have dwindled in downtown Boston.

If passed, Massachusetts would be one of the first states to regulate short-term rental units. A few cities, such as San Francisco, California and Portland, Oregon, have introduced similar regulations. New York State has some rules in placed, but has found them to be ineffective.

“Banning short-term rentals was a path we did not want to go down,” added Michlewitz. “We want the innovative economy to prosper in the Commonwealth, not be stifled, but we also want consumers to feel confident and safe when they are using these sites. I think we struck the right balance with this bill.”

The State collected $562 million in hotel tax revenue in 2011 with cities in the Commonwealth collecting an additional $358 million. Short-term rental sites in Boston had over $10 million of business in 2014 with the growing platform surging in popularity.

The legislators say it is most important to bring these types of residential units under code with inspections for fire safety. Property owners would also be required to obtain proper insurance.

“We applaud Representatives Michlewitz’s and Vincent’s leadership on this issue and look forward to working with them to secure passage of legislation that creates a fair playing field in regard to online services. The lodging industry in Massachusetts is under a fair amount of scrutiny in relation to issues like fire safety, sanitary conditions and ADA compliance, and we want to make sure visitors to the Commonwealth are protected no matter where they choose to stay,” stated Paul Sacco, President and CEO of the Massachusetts Lodging Association.

The bill would also allow cities and towns to collect additional excise taxes beyond the State’s 5% requirement, similar to the Boston hotel tax. Cities would also obtain the power to limit short-term rentals to owners primary residence, thus prohibiting renters from sub-leasing to short-term rental services. Fines for non-compliance with the proposed regulations could be as high as $1,000 per day.

“residents have expressed concerns that AirBnb-type services are absorbing much of the available housing stock. Listings for regular apartments have dwindled in downtown Boston.”

…..

I think it’s safe to say that NIMBYism; those fighting the size of new development, as well as requiring high onsite parking at said development and a current migration trend to urban cores has a much larger impact on the “available housing stock” of downtown Boston.

If I were against AirBnb I’d stick to the safety and tax argument.

Nimby is used whenever people speak up to preserve and protect their neighborhood. People should be congratulated for speaking out, not dismissed with this overused cliché.

Time to retire this negative word.

Thank You so much Aaron for addressing this AIRBNB issue. This small little congested neighborhood of ours does not

need another problem. SAFETY should always be the 1st Issue & the 2nd Issue should be Tax Evasion. I made it very clear

that 177 Endicott St. has an Airbnb on the 1st Floor ( owner is JARED THOMAS) and I don’t know if all the condo owners or those renting on

a monthly basis are even aware of this. All of us like Money, but when & where does this Lust for Money stop.

Airbnbs, Bars, Restaurants, Roof Decks & now a Casino in walking distance of the North End, (if you are somewhat of a

walker). Aaron, I hope you also give serious thought about the 4 a.m. closing of bars & restaurants, we don’t need it.

If the City & State feel this great need for 4 a.m. closings, it should never be in our neighborhoods, where there are

young professionals who have to work on weekends, especially in the Medical field, and there should also be a

concern for young parents who are trying to raise their children, this is NOT just an over 65 issue. I also take notice of

all these thumbs down for very important issues, which leads me to believe they have a personal interest in 1 or all

of the above mentioned. All that glitters in not always Gold, and sometimes the RISK is not worth the REWARD.

Aaron, This a serious issue, in my condo building someone bought a unit as a owner occupied. From day #1, we noticed sometimes 5 and 6 people going up the stairs and into his unit, sometimes 2.

Soon enough they started to leave, once a baby carriage behind and whatever they did not need to go home with was discarded in the entry hall. Also, there are 9 single women living here on their own, I wonder how many people would like to have strangers roaming their building with their personal property at risk while the owner of the unit is making money using our water, heat, etc. and taking the residential exemption. Patricia Bono

Provincetown has been trying to do this for years and it has constantly been blocked by state legislators. This change is long overdue.