The history of immigration in this country is one of exploitation; the wealthy, property owning classes exploiting the poor and desperate. We saw this when our parents and grandparents immigrated to America and we still see it today. When cheap labor was needed, the gates to the United States were thrown open and a tidal wave of immigrants flooded into the country, but when times were hard or jobs scarce, the immigrants were scapegoated and either expelled or excluded. A hundred years ago America imported low wage workers to work in the factories. Today, we export factories to third world countries where they have an endless supply of cheap labor. That’s the American way of doing business.

Once the Western railroads were built and Chinese “coolies” were no longer needed, Congress passed the Chinese Exclusion Act of 1882 which stayed in effect until 1943. Italians and Jews posed an even greater threat to the Nativists. Italians were considered anarchists and murderers and Jews were Bolsheviks and labor agitators. The senator from Massachusetts, Henry Cabot Lodge, was instrumental in the passage of the Emergency Immigration Act of 1921 which placed strict quotas on Jews and Italians. Private institutions also placed quotas on the children of ethnic immigrants. In 1922 the president of Harvard, A. Lawrence Lowell, instituted quotas for Jews who applied, and in 1935 the dean of the Yale Medical School instructed his admissions department to do the following, “Never admit more than five Jews, take only two Italian Catholics, and take no blacks at all.”

Nativists were surprised to learn that Immigrants weren’t stupid; they quickly figured out the score and adjusted their business activities to their own advantage. Italians, in particular, engaged in a form of international arbitrage where they used American money, which was backed by gold, to purchase goods, mainly food, in Italy for resale in the States. Fulton Street in the North End had several packing houses where Italian foodstuffs were repackaged under proprietary labels and sold in local Italian grocery stores. Brands such as Pastene, Progresso and Contadina still exist today. A vast amount of American money was remitted back to Italy to be deposited in Italian banks. Italians traveled back and forth to Italy with thousand dollar bills sown into their trousers and several North End families made small fortunes in this carry trade.

This brings us to the most famous North Ender of all, the ultimate “Bird of Passage,” the man whose name is synonymous with deviousness and financial manipulation, Carlo (Charles) Ponzi. Looking at Ponzi’s pyramid scheme from a modern perspective it seems unbelievable that people could be so gullible as to invest their life’s savings in such a sketchy enterprise, but when you consider that many Italians were already engaged in shadowy international arbitrage, Ponzi’s scheme almost makes sense.

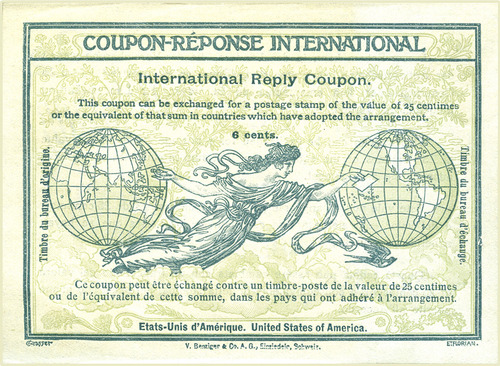

Ponzi was a hustler from the start. He was born in my grandmother’s province of Emilia/Romagna and moved to Boston in 1902 where he worked as a bus boy and waiter until he was fired for shortchanging customers. He then moved to Canada and worked at one of the Italian banks, Banca Zarossi, where he learned the banking trade. When that bank went bankrupt he started smuggling Italian immigrants from Canada into the US, but he was arrested and served time in jail. He moved back to Boston, got married, and had an epiphany when he received a letter from an acquaintance in Spain. Attached to the letter was an International Reply Coupon which could be used to buy a return stamp. Ponzi realized he could buy these coupons in Italy and sell them in the US for a tremendous profit. Conceptually it made sense, and in 1919 he opened an office on School Street next to City Hall and called his business the Securities Exchange Company. He offered investors a 50% return in forty five days or 100% in ninety days. Early investors were, of course, paid and word spread rapidly through the Italian American community and beyond. At its peak he was taking in several hundred thousand dollars a week and it’s said that 75% of the Boston police force had invested money with him. Ponzi hid much of his money in the Hanover Trust Co. where he had a safe deposit box filled with thousand dollar bills. The entire scheme was exposed by the Boston Post who hired Clarence Barron, the head of the Dow Jones Co., to investigate. He found there were nowhere near enough International Reply Coupons in circulation to cover Ponzi’s promises. Ponzi was arrested for mail fraud and there was a spectacular trial with rumors of hidden partners and even the involvement of the Black Hand society. Ponzi was sent to jail for several years. When he was released he moved to Brazil and died penniless in Rio de Janeiro in 1949. It is estimated that people lost over 20 million dollars in his scheme even though it lasted only one year.

I suppose the moral to this story is, the next time you go out to eat in the North End and the waiter or bus boy suggests something that sounds too good to be true, be careful and stick with the chicken parm.

Nicholas Dello Russo is a lifelong North Ender and columnist. Often using vintage photographs, Nick tells the stories of growing up in the North End along with its culture and traditions. It was a time when the apartments were so small that residents were always on the streets enjoying “Life on the Corner.” Read more of Nick’s columns.

Advice taken–great job, Nick.

Nick, Great round-up of a long story. I have heard that because of Ponzi and distrust of hustlers, the North End branch Post Office had more postal savings accounts, and money deposited, than any Post Office branch in the country. Immigrants trusted Uncle Sam. The postal savings system was abolished in the 1960s.

You are correct, Bob. A lot of that money was sent overseas, back to Italy. It’s an untold but important story. The problem was, the individual amounts were so small no records were kept.

The Ponzi story is fascinating and the whole truth will never be known. I read a lot of contemporary news reports and the cast of characters was astounding.

A book — probably one of several — was written about Ponzi by Donald Dunn, a colleague at Business Week. Someone mentioned a Ponzi scheme in a staff meeting and he had never heard of it and got intrigued. Don was quoted after the Madoff collapse. I think a new edition of his Ponzi book was published.

Loved the Ponzi Story Your stories are alway great reading.

Madoff is still making money in prison. He bought up all the Swiss Miss chocolate in the commissary and sells it for a profit to his fellow inmates. He should give the money to a charity.

nice work, Nick…